The Strategic Imperative: Why Card Portfolio Automation Is a Must for Banks

Credit cards continue to be among the fastest-growing and most profitable products in retail banking. In high-growth markets like India and Southeast Asia, the opportunity is clear: reports from PwC and Precedence Research project a CAGR exceeding 20% (PwC Indian Payments 2024, Precedence Research) for the Indian credit card market over the next five years.

But while portfolios scale, the systems behind them haven’t kept up.

Legacy systems, manual workflows, and fragmented customer journeys are holding back scale. What should be a high-return business is often weighed down by high cost-to-income ratios and underwhelming engagement.

In this environment, real-time, intelligent automation has become a strategic imperative. Not an efficiency upgrade, but a foundational capability to unlock growth and responsiveness at scale.

The “Leaky Bucket” That’s Holding You Back

Manual-heavy systems create more drag than lift.

Customer acquisition, onboarding, and rewards are significant cost centers. McKinsey estimates they can account for up to 40–50% of operational expenses in a card portfolio (McKinsey’s Global Banking Review 2023). Credit cards offer inherently high RoA – often 3–5x that of traditional banking products, but the margin potential is often lost to inefficient processes.

The signs are everywhere:

- Drop-offs post-issuance: Activation remains a challenge for many issuers, with early-stage customer churn limiting the overall impact of acquisition campaigns.

- Disconnected journeys: Generic cross-sell offers, slow service workflows, and one-size-fits-all comms are still the norm.

- Reactive Risk Ops: Delayed fraud detection and churn management due to manual triggers.

For a product with some of the highest RoA in banking, it’s a paradox. Without automation, every phase of the card lifecycle leaks revenue, customer trust, and time.

The Strategic Upside: What Portfolio Automation Unlocks

When done right, automation creates value across the lifecycle. Here’s what leading banks are achieving with portfolio automation:

- Activation & Early Engagement

Real-time nudges post-issuance help improve activation rates by up to 30% within the first 30 days. (Capgemini World Payments 2023). - Spends & Stickiness

Triggered campaigns based on dips in usage, category affinity, or seasonal context have improved SPAC by 15–20% in benchmark programs. - Cross-sell & Conversions

Using transaction signals, banks have driven 25%+ increases in EMI conversions and upgrades. - Cost Efficiency

Banks automating service workflows and campaign ops have seen up to 40% reduction in operating costs across customer support, rewards ops, and comms.(Capgemini World Payments Report 2023 — PDF)

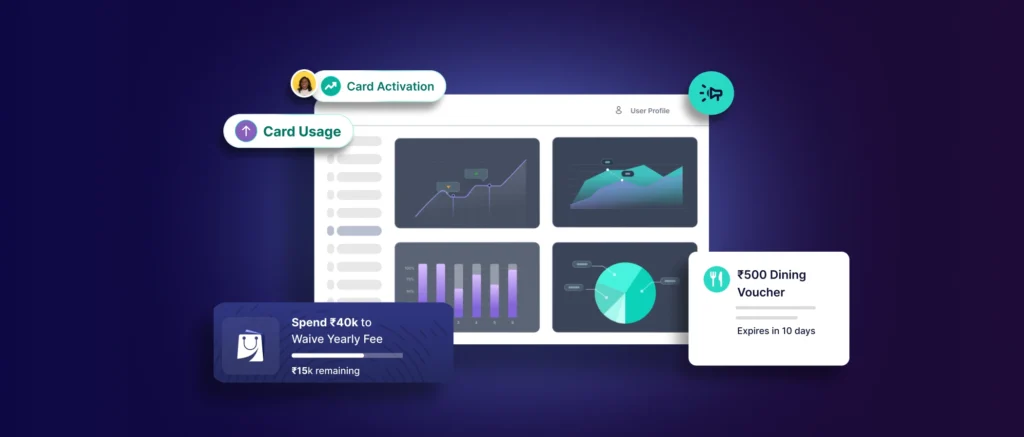

What Portfolio Automation Looks Like with Smart Engage

Automation isn’t just turning on a few journeys. It’s about building a connected, intelligent engagement layer.

Our fully automated program and portfolio management tool, Smart Engage helps banks move beyond fragmented workflows. It brings together activation triggers, lifecycle nudges, usage stimulation, and intelligent cross-sell – all in one place. More importantly, it enables banks to deliver hyper-personalisation at scale, boost engagement, and drive spends, all while keeping operational costs in check.

Here’s how Smart Engage brings intelligent automation to life:

- Works across the lifecycle

From activation to usage, cross-sell to collections – orchestrate engagement that adapts in real-time. - Launch fast, adapt faster

Use pre-built playbooks or customize your own – all via a no-code dashboard. - Integrates into your ecosystem

Smart Engage works seamlessly with your CRM, core banking, and campaign tools. - Control Stays With You

Get full control and visibility without needing to chase down multiple tools or teams.

Smart Engage is designed to scale with this evolution – built for automation today, ready for intelligence tomorrow.

Time to Build the Next Layer

Portfolio automation is no longer optional. To drive profitable growth, deliver on rising customer expectations, and meet compliance with agility — automation must be embedded at the heart of your card strategy.

Explore how Smart Engage can transform your portfolio into a high-performance engine.

Get in touch → business@hyperface.co