Beyond UPI: Is Your PPI Stack Ready for the ₹5 Trillion Shift?

The Digital Payment Revolution’s Second Wave

In a nation where cash was once king, India’s digital payment revolution has been nothing short of remarkable. While UPI continues to dominate person-to-person and merchant payments, a quiet but meaningful resurgence is underway in another space — prepaid payment instruments (PPIs).

Prepaid Payment Instruments (PPIs) are instruments used for purchasing of goods and services and conduct of financial services among others, against the money stored in them, better known as digital wallets, prepaid cards, smart cards, and other stored-value solutions. These have become essential tools for millions of Indians navigating the new digital economy.

The PPI Opportunity Has Several Tailwinds Today

- Purpose-built wallets for teens, travelers, employee reimbursements, and savings are trending

- Fintechs want speed to market without jumping into complex banking licenses

- Regulatory frameworks have matured, along with the infrastructure needed to comply

Adding to this momentum, the RBI’s green light for PPI integration with third-party UPI platforms is set to supercharge the sector. By simplifying transactions and boosting interoperability, this move unlocks powerful new use cases and paves the way for rapid PPI adoption. It’s a game-changing moment that promises to fuel innovation and usher in the next big leap for India’s digital payments ecosystem.

Modern use cases like youth banking, digital gifting, employee expense management, and embedded finance demand lightweight, flexible financial containers. PPIs are tailor-made for this — provided they’re built the right way.

The Evolution of India’s PPI Landscape

India’s PPI journey began modestly in the late 2000s with closed-loop gift cards and basic mobile wallets. The watershed moment came in 2017 when the Reserve Bank of India (RBI) formalized the PPI framework with its first draft Circular, creating legitimate space for non-bank entities to participate in the payments ecosystem. Through consistent updates to the Master Directions on Prepaid Payment Instruments, RBI has continuously refined the blueprint for growth in this sector.

PPI Market by the Numbers

According to PWC’s Indian Payment Handbook:

What began as simple stored-value cards has evolved into sophisticated financial tools. Modern PPIs now offer:

- Full-KYC open-loop systems

- UPI integration

- Card issuance capabilities

- Microlending features

- Investment options through partnerships

Major banks, fintech startups, and even technology companies have entered the arena, creating one of the most dynamic and competitive PPI ecosystems globally.

The Regulatory Tightrope

The RBI has taken a progressive yet cautious approach to regulating PPIs, balancing innovation with consumer protection and financial stability. This has created a continuously evolving compliance landscape that PPI issuers must navigate.

Key Regulatory Requirements

Recent regulatory developments illustrate the complexity:

- KYC Requirements

All PPIs must now comply with KYC requirements, with transaction limits varying based on the level of KYC completed—classified as Full-KYC PPIs and Small or Minimum-Detail PPIs. - Interoperability Mandates

The RBI has mandated interoperability between PPIs, requiring technical systems that can handle cross-platform transactions. - Enhanced Security Protocols

Multi-factor authentication, dynamic risk scoring, and robust fraud monitoring have become regulatory expectations rather than options. - Escrow Account Management

Strict requirements govern how customer funds are held and managed. - Transaction Limits

Granular limits on loading, transactions, and balances based on KYC status and account type.

The Scalability Imperative

While managing compliance, PPI providers simultaneously face unprecedented scalability challenges. India’s digital payments ecosystem experiences transaction volumes and growth rates that test even the most robust systems:

- The post-pandemic shift has accelerated digital payment adoption across demographics

- User expectations for real-time processing have become the norm, not the exception

- Festival seasons regularly see transaction spikes way above normal volumes

- Flash sales on e-commerce platforms can generate millions of concurrent transactions

The Cost of Inadequate Infrastructure

Legacy payment infrastructure, often built on monolithic architectures with batch processing paradigms, simply cannot cope with these demands. Technical limitations become business limitations as customers experience:

- Transaction failures during peak periods

- Delayed settlements affecting merchant satisfaction

- System downtime during critical shopping events

- Slow response times that interrupt the purchasing flow

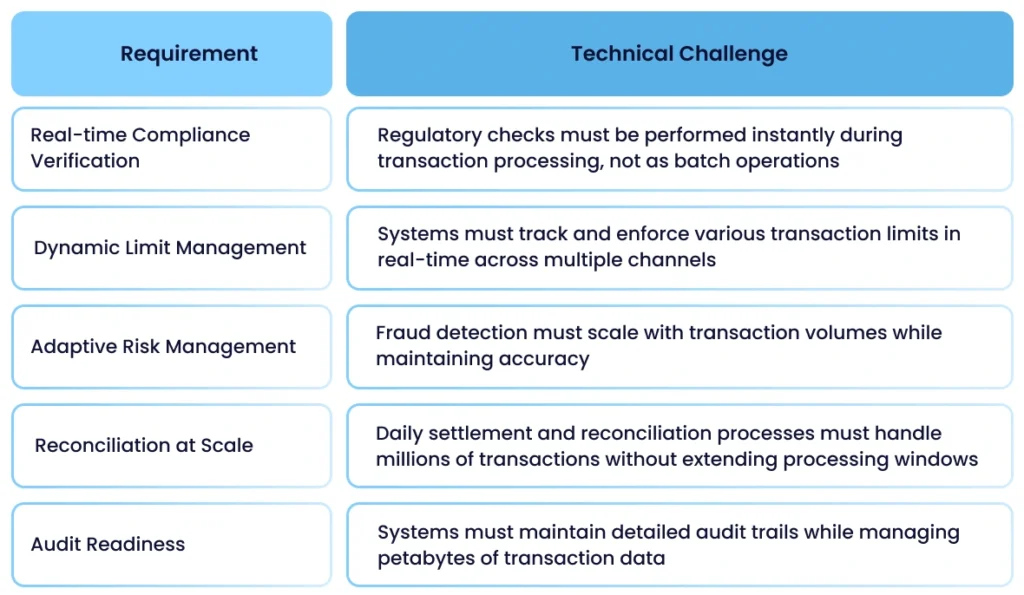

Where Compliance Meets Scalability

The true challenge for PPI providers emerges at the intersection of compliance and scalability. These are not separate concerns but deeply intertwined requirements:

The technological foundation that supports these dual requirements has become the defining factor separating market leaders from laggards. PPI providers operating on outdated or patchwork systems find themselves in an increasingly unsustainable position – unable to meet regulatory requirements efficiently while also failing to scale with market growth.

The Strategic Advantage of Modern PPI Infrastructure

As India’s PPI ecosystem continues to mature, the technology infrastructure that powers these services has become the critical differentiator. Forward-thinking banks and fintechs are reimagining their PPI stacks from the ground up, embracing modern architectures designed specifically for compliance and scalability.

This is where specialized technology platforms like Hyperface are making a significant impact. Rather than building complex PPI systems from scratch—a process that can take months and requires deep regulatory expertise—financial institutions can leverage proven infrastructure that handles the heavy lifting of compliance, scalability, and integration challenges. This allows fintechs and banks to focus on what truly differentiates them: creating exceptional user experiences and innovative financial products tailored to specific market segments.

Take Jupiter’s innovative approach to youth banking, for example. By leveraging Hyperface’s full-stack PPI solution, Jupiter’s innovative wallet experience meets the unique needs of its young user base while maintaining full regulatory compliance and seamless UPI integration. The result is a solution designed specifically for India’s digital-native generation, launched at a fraction of the time and cost of traditional approaches.

[Read more about Jupiter’s PPI implementation and how they’re revolutionizing youth banking in Part 2 of this series.]

Questions to Consider for Your PPI Strategy

Product Strategy and Market Positioning:

- What specific customer segment will your PPI serve? (Youth banking, corporate expenses, travel, savings, etc.)

- How will your PPI create unique value that traditional banking products cannot?

Technical Foundation and Speed to Market:

- Are you building infrastructure from scratch, or leveraging proven platforms to accelerate time-to-market?

- How quickly can your current infrastructure adapt to new regulatory requirements?

- Can your systems handle a 10x increase in transaction volume during peak periods?

- Does your architecture support rapid deployment of new PPI features and use cases?

Compliance and Risk Management:

- Are compliance checks integrated into real-time transaction processing?

- How will you manage KYC requirements across different user segments and use cases?

- Can your risk management systems adapt to new fraud patterns as you scale?

PPI providers building structured, innovative and robust solutions that deftly navigate both regulatory requirements and scalability demands will find themselves best positioned to capture the massive opportunities in one of the world’s most dynamic payment markets.

Ready to modernize your PPI infrastructure? Schedule a consultation with our team to discuss your specific requirements.