The Pitfall of Generic AI in Credit Cards: Why Purpose-Built, Credit-Native AI Is the Future

AI is changing the way banking works, helping teams move faster, get sharper insights, and connect better with customers. But, behind the momentum lies a sobering reality: the proliferation of generic AI models built for broad, cross-sector use. While powerful in general contexts, these models fall short when applied to the financial ecosystem. They lack the precision,context and compliance safeguards required in banking, creating risks for both institutions and their customers.

Why Generic AI Falls Short in Financial Services

Generic AI leans on massive, general-purpose datasets. That makes it prone to blind spots and biases—problems that can creep into credit decisions, reporting, or regulatory checks. And regulators worldwide are already paying closer attention. With laws like GDPR, the Equal Credit Opportunity Act, and emerging AI standards, banks need AI that is transparent and audit-ready. Black-box models that can’t explain their outputs only add more risk.

The Credit Cards Challenge

The gap is even clearer in credit cards. Today, card issuers are focusing less on unbridled growth and more on building sustainable portfolios, managing risk better, and elevating customer engagement. In this environment, one-size-fits-all AI cannot adapt quickly enough. What banks need instead are solutions designed for precision, explainability, and compliance from day one.

Hyperface AI Labs: Built for Credit Cards

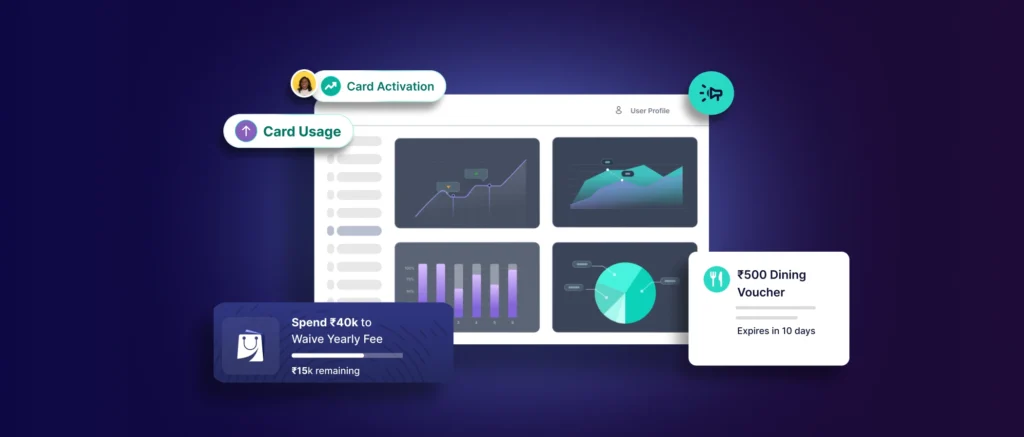

That’s the gap Hyperface AI Labs fills in —AI built from the ground up for credit cards. It rests on three simple pillars: deep domain knowledge, compliance built-in, and flexibility to scale. Instead of running on broad, generic data, it works with transaction patterns, customer behavior, portfolio events, and risk signals to give banks insights they can trust.

Here are two examples of what this looks like in action:

Making Data Easy to Use

Traditionally, customer data is buried in complex databases, only accessible if you know how to write SQL. Credit-native AI changes that.

HyperQuery lets portfolio managers and business teams ask questions in plain English—like “Which customer groups are most likely to upgrade to a premium card next quarter?”—and get clear answers instantly. It turns locked-up data into a tool anyone can use to make better decisions.

Smarter Customer Support

The same intelligence extends to customer conversations.

HyperAgent, a contextual AI assistant, can handle onboarding, rewards, or servicing with full awareness of the customer’s financial situation. That means faster, more relevant support—with transparency and compliance built in.

These are just two examples. Hyperface AI Labs is designed to let banks co-create and roll out AI modules quickly, without heavy infrastructure build-outs.

From Experiments to Real Advantage

Banks that move beyond experimenting with generic AI and adopt purpose-built, credit-native intelligence stand to gain a real edge: clearer decision-making, better compliance, more personalized engagement, and stronger resilience. In other words, AI that doesn’t just look good in a pilot but actually drives sustainable growth.

Why the Future Is Credit-Native

Banks that embrace AI solutions designed specifically for financial services will be ready to deliver smarter, safer, and more engaging credit experiences tomorrow. Talk to us today about how Hyperface AI Labs can enable that for your bank.