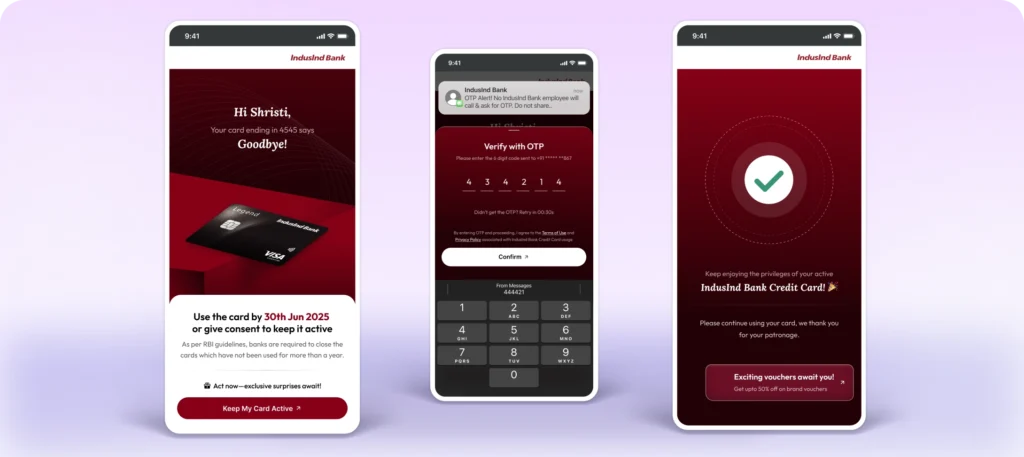

Customer Consent Capture Journey

A low-friction, OTP-based flow to obtain customer consent for re-engagement initiatives—ensuring regulatory compliance and a seamless user experience. For instance, this flow can be used to reactivate credit cards just before they are automatically deactivated after 365 days of inactivity, helping banks retain valuable cardholders.

What does it solve?

This newly built journey helps banks retain dormant yet valuable cardholders—many of whom are affluent or were previously active—by proactively prompting them to keep their cards active or make a quick transaction. It also raises awareness among users who may not realise their inactivity has triggered regulator-mandated closure, using timely, personalised nudges. Most importantly, it ensures regulatory compliance by capturing OTP-based consent—removing the need for any manual intervention.

Key Features

- Personalised landing page with customer name, card variant, and closure date prefilled

- OTP-based consent flow with mobile number auto-populated for ease of use

- Multi-stage campaign builder segmented by urgency, with tone escalation from reminder to final alert

- Detailed logs to support any internal bank audit workflow

Benefits You’ll Love

- Reduces customer churn from auto-closures, especially among high-value dormant users

- Builds awareness through targeted communication that educates users about upcoming closure timelines

- Ensures regulatorily compliant consent capture, with securely logged and time-stamped verification

Sample workflow

- Identify Eligible Customers

→ Detect cards with no transactions in 365 days

→ Auto-calculate days left to closure - Segment by Urgency

→Segment cardholders based on proximity to closure

→ Escalate tone from reminder to final notice based on timing - Trigger Communication

→ Personalised messaging with a dynamic consent link

→ Tone evolves with each phase to drive urgency - Capture Consent

→ Customers click → Submit OTP → Consent logged - Sync with Bank

→ Verified consents sent to issuing bank systems to halt auto-closure