Enhanced Maker–Checker for Nudges

Quick Overview

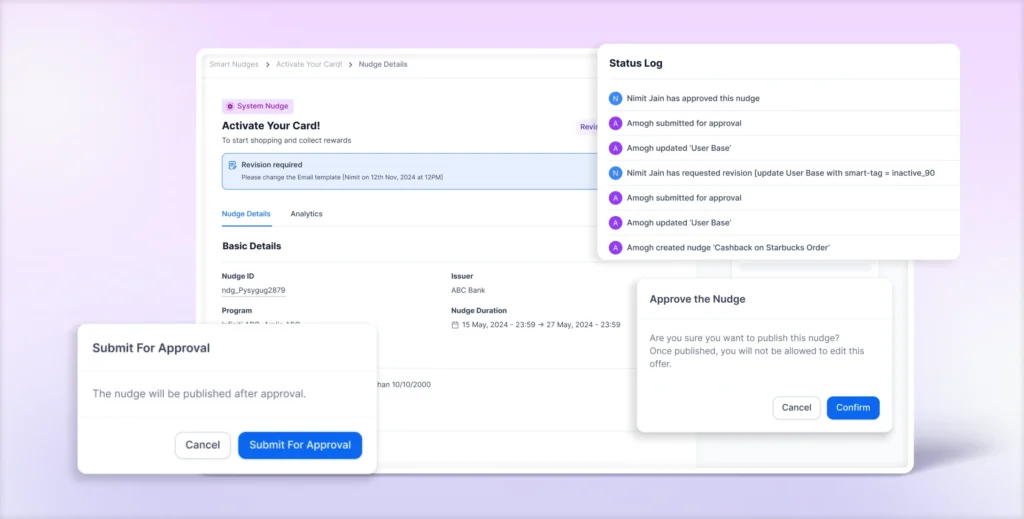

The Maker–Checker workflow for customer nudges now comes with clearer controls, tighter governance, and full execution visibility. Nudges now move through structured approval states with explicit role separation, ensuring every activation is reviewed, auditable, and compliant. This enables banks to scale proactive engagement without operational risk.

What does it solve

As the volume of customer campaigns and nudges increases, this ensures teams have stronger guardrails around who can create, modify, and approve customer communications, particularly for regulated issuer programs. Enforced review checkpoints eliminate the risk of accidental activations and audit gaps.

With the enhanced Maker–Checker flow, banks can now ensure every nudge is reviewed by the right stakeholders before going live, while maintaining speed and operational efficiency.

Key Features

- Issuer and portfolio-level Maker–Checker controls for Nudges

- Clear separation of roles between creation and approval

- Structured nudge lifecycle states including Draft, Pending Approval, and Active

- Revision workflows with comments for feedback and corrections

- Comprehensive audit logs with user, action, and timestamp tracking

- Automated email notifications at key approval stages

What you’ll love

- Prevents unintended or premature nudge activations

- Strengthens compliance and governance for issuer programs

- Clear ownership across creation and approval teams

- Faster, more predictable reviews with built-in visibility

- Audit-ready logs without manual tracking or follow-ups

How does it work

- A Maker creates or edits a nudge in Draft state

- The Maker submits the nudge for approval

- The nudge moves to Pending Approval

- The Checker reviews the nudge and either approves it or requests changes

- Approved nudges move to Scheduled or Active states, while revisions return to the Maker

- All actions are logged automatically and notified via email