Flexible Benefit Qualification Date for Credit Card Offers

Quick Overview

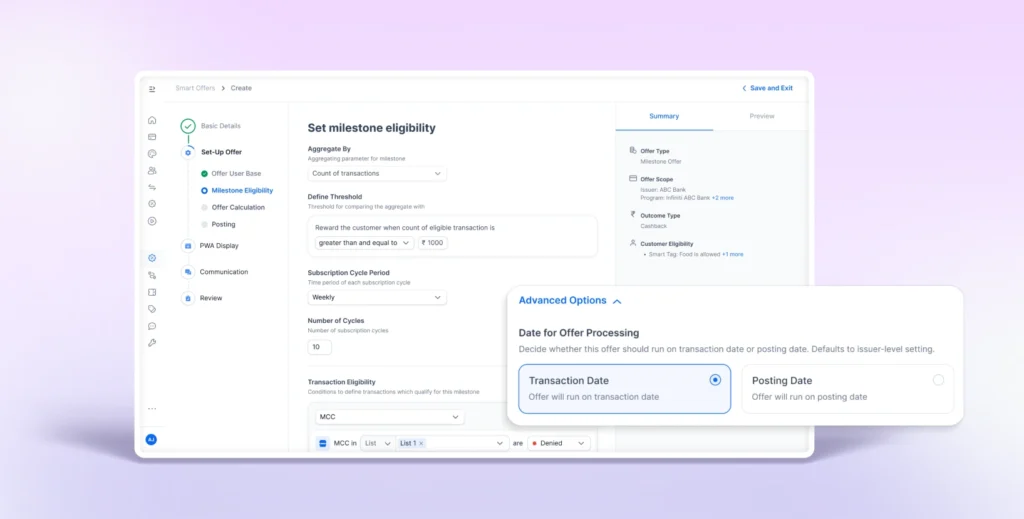

Banks can now control which date is used to evaluate credit card benefits, either the transaction date or the posting (settlement) date. A default evaluation date can be set at the issuer level, with the flexibility to override it for specific offers when required. This ensures benefit logic aligns cleanly with internal accounting, settlement workflows, and customer expectations.

What does it solve

Within banks, different teams often define “qualification” differently. Some rely on the transaction date, while others depend on the posting or settlement date. Earlier, all benefits were evaluated only on transaction date, limiting flexibility and creating mismatches across campaigns.

This update removes that constraint by allowing banks to configure the evaluation date explicitly, ensuring consistent and accurate benefit computation across use cases.

Key Features

- Issuer-level default setting for benefit evaluation date

- Optional benefit-level override for specific offers

- Simple configuration within the offer setup flow

- Backward-compatible design with no impact on existing offers

What you’ll love

- Aligns benefit logic with settlement and accounting processes

- Supports multiple campaign types without any code changes

- Reduces customer disputes caused by date mismatches

- Safe defaults prevent accidental misconfiguration

Use Cases

- CVP and milestone benefits evaluated on posting date for accurate settlement-based rewards

- Portfolio offers evaluated on transaction date for instant progress and gratification