Intuitive Spend Insights for Cardholders – Now on PWA

Quick Overview

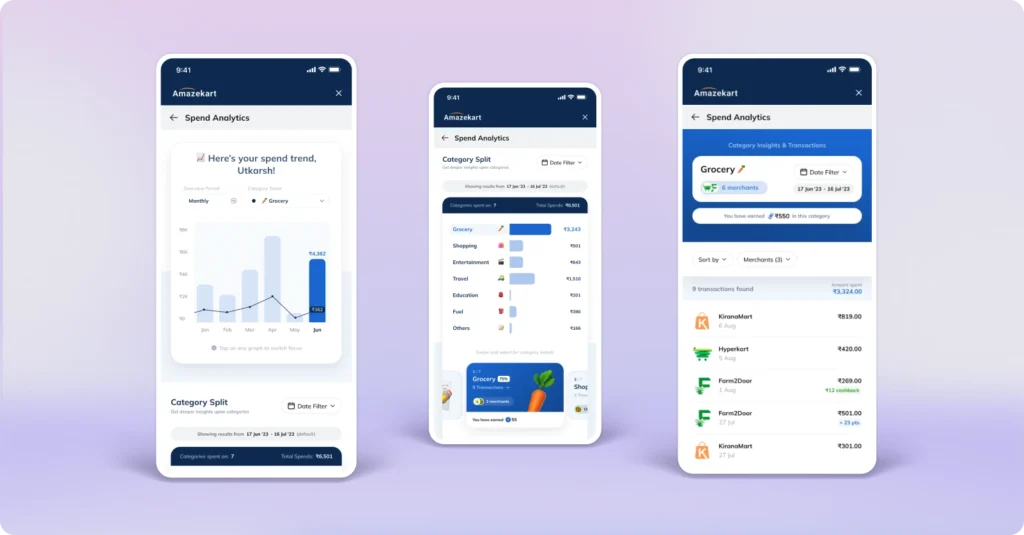

Our Embed Next product now offers a fully interactive Spend Analytics experience on the PWA interface, enabling customers to visualize and understand their spending patterns through intuitive graphs, category-level insights, and rewards summaries. For banks, the system offers complete backend control over how spending categories are defined and grouped for every co-brand program, without needing UI changes.

What Does It Solve?

Understanding spending behavior can often be challenging for cardholders, especially when transactions span multiple categories and merchants. Similarly, banks face limitations in offering custom, co-brand program-specific spend insights without engineering dependencies.

Spend Analytics addresses both fronts—delivering a clean, visual interface to customers and offering modular backend logic to define, manage, and optimize spend categories at a program level.

Key Features

- Visual Spend Trends – Monthly bar and line graphs to track category-wise spending over time.

- Category-Level Breakdown – See a snapshot of total spends across groups like Grocery, Shopping, and Travel.

- Category Drill-Down – Tap into any category for merchant-wise details, rewards earned, and transaction history.

- Top 3 Spends Summary – Instantly view top spends with associated rewards and transaction data.

- Filters & Sorting – Customize data views by date range, merchant, or spend amount.

- Rewards Tracking – Displays cashback/points earned per transaction and category.

- Modular Spend Categories – Define categories at the backend using MCC codes, transaction types, or MIDs.

Benefits You’ll Love

- Instant Clarity – One glance gives users a complete picture of their spending behavior.

- Program-Specific Customization – Tailor spend categories and grouping logic per card program.

- Backend Flexibility – Make category-level changes without touching the front-end.

- Increased Engagement – Help users track spending and optimize rewards, driving better card usage.

Use Cases

- Lifestyle Programs – Spotlight spends on Dining, Travel, and Shopping with custom insights.

- Fuel-Heavy Cards – Prioritize categories like Fuel and Auto for relevant cardholders.

- Rewards Optimization – Enable users to identify where they earn the most cashback or points.

How It Works

- Category Setup – Program managers define spend groups from the dashboard using attributes like MCC, MID, or transaction codes.

- Real-Time Segregation – Every transaction is automatically grouped based on the backend rules.

- Dynamic UI Rendering – The frontend displays up-to-date spend insights and summaries instantly.

Whether it’s 3 categories or 30, the setup is fully modular—making Spend Analytics adaptable to any card program without additional development effort.