5 Proven Tactics for Higher ROI | Festive Marketing Playbook 2025

As India’s festive season approaches its grand culmination, credit card usage continues to mirror the surge in consumer sentiment and spending power. With GST reductions across key categories adding extra fuel to demand, cards have become the default choice for festive purchases — from everyday indulgences to high-ticket spends.

For credit card issuers, this moment brings both opportunity and challenge:

How do you drive higher card usage and engagement without diluting profitability through blanket rewards?

At Hyperface, we help issuers solve this at scale through Smart Engage, our unified engagement platform that drives portfolio growth and profitability through hyper-personalised engagement and end-to-end automation.

At the heart of Smart Engage is the Smart Benefits Engine, powering campaign orchestration, cohort management, and real-time performance tracking at scale.

In one of our recent festive implementations, Smart Engage enabled a leading Indian private bank achieve 60% engagement among opted-in users through personalised offers, milestone-based rewards, and real-time tracking.

Building on this success, here’s our 5-pillar playbook for creating credit card campaigns that deliver real ROI.

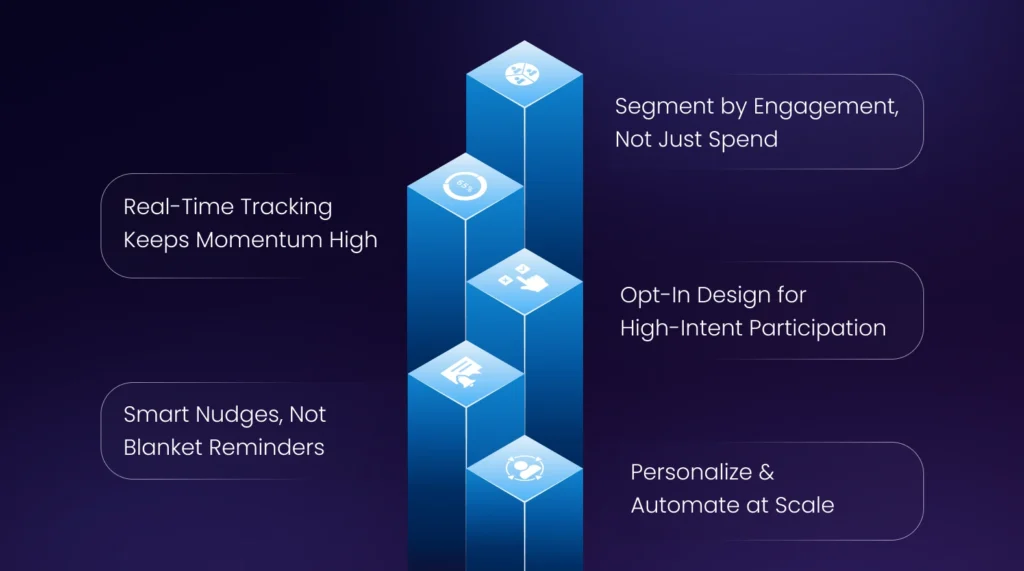

The 5-Pillar Festive Campaign Framework

1. Segment by Engagement, Not Just Spend

The most effective festive campaigns go beyond static segmentation. Using Smart Engage Smart TagsTM, we designed a 20-way matrix based on card usage and spend tiers. Each cohort received milestone targets and rewards designed to feel attainable yet motivating.

Pro Tip 1: When rewards match intent, customers participate — not because of the offer, but because it feels designed for them.

2. Opt-In Design Drives High-Intent Participation

Instead of pushing campaigns to the entire base, customers were invited to opt in after previewing their rewards and milestones upfront. The consent capture ensured that only genuinely interested users participated — reducing communication fatigue while improving conversion quality.

Pro Tip 2: Self-selected users engage deeper, spend more, and deliver higher ROI than those enrolled by default.

3. Personalize Milestones, Automate at Scale

Each participant’s milestone and reward was personalized using Smart Engage’s Smart Benefits Engine — from cashback to reward points to vouchers.

Eligibility checks, progress tracking, and reward computation ran seamlessly through APIs, removing manual overheads and errors.

Pro Tip 3: Personalization creates relevance, while automation keeps campaign costs predictable.

4. Real-Time Tracking Keeps Energy High

Festive campaigns often lose steam when users can’t see progress. With the Live Progress Tracker, customers could view their journey in real time — motivating them to complete milestones before the campaign window closed.

Pro Tip 4: Progress visibility sustains excitement — every transaction feels like a step closer to a win.

5. Smart Nudges Beat Blanket Reminders

Communication is most effective when it’s timely and context-aware. Using the Smart Engage Smart Nudges feature, reminders were dynamically adjusted — frequent nudges for inactive users, minimal touchpoints for those already progressing well.

Pro Tip 5: Smart timing and tone keep engagement authentic, reducing noise and preserving brand goodwill during high-volume marketing periods.

The Takeaway: Precision Outperforms Promotion

The campaign delivered over 60% engagement among opted-in participants — proof that targeted, ROI-first design outperforms mass-scale promotions.

The new festive playbook isn’t about spending more on rewards — it’s about spending smarter on engagement.

Ready to Scale Smarter?

Hyperface Smart Engage platform helps issuers design, automate, and scale hyper-personalized campaigns from a single window dashboard.

Let’s explore how your next campaign can drive higher ROI.

Subscribe to our newsletter for insights on powering modern card programs.

Follow us on Linkedin for the latest in credit card innovation.