Journey Engine Dashboard 2.0

By Editorial Team

4th June 2025

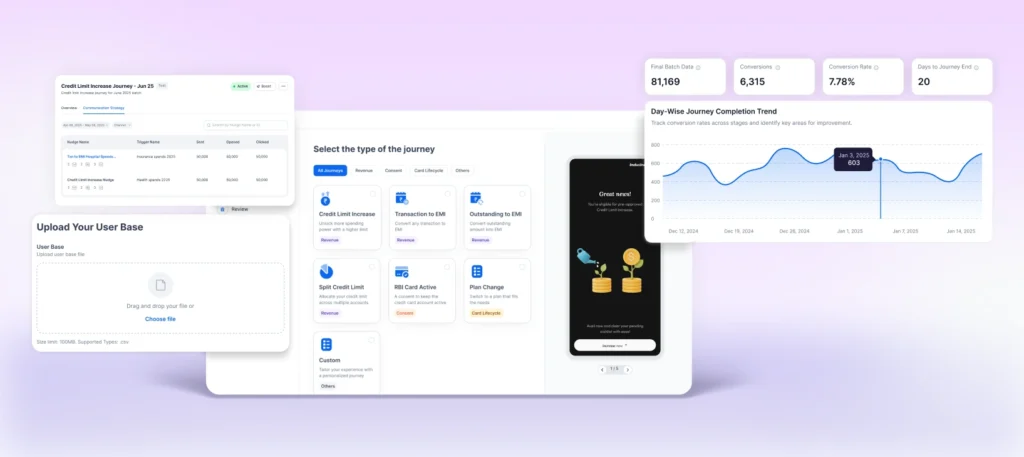

Program managers can now create and launch credit card journeys—from a fully self-serve dashboard. From batch upload to campaign execution without deep tech dependencies or complex integrations, this reimagines how banks create, launch, and monitor credit card engagement journeys.

What does it solve?

This new version eliminates the operational delays of coordinating with multiple teams and systems to set up communication journeys. Banks can now independently launch personalised campaigns, track performance in real-time, and automate recurring journeys — accelerating go-to-market timelines with zero coding effort.

Key Features

- Direct batch uploads through the dashboard with no bank-side tech integration

- Predefined journey templates with personalised nudges and live performance tracking

- Configurable recurring journeys with SFTP-based file ingestion and auto-reporting

Benefits You’ll Love

- Launch engagement journeys in minutes — no engineering support required

- Track campaign effectiveness with clear visibility into send, open, and click metrics

- Easily scale with automation-ready configs for file processing and reporting

Use case in Action

Live with IndusInd Bank

- Regulatorily compliant activation consent journeys

- Transaction to EMI conversion

- Outstanding balance to EMI conversion

Coming Soon

- Line-by-line credit limit (LBCL) journeys

- Credit plan upgrade nudges

- Credit line increase (CLI) prompts

How it works

- Select Journey Template

→ Pick from a library of ready-to-use templates on the dashboard - Upload Customer Batch

→ Manual upload or auto-pick from configured SFTP - Create & Launch Nudges

→ Multi-channel comms with customised messaging - Track Campaign Performance

→ Real-time metrics on sent, opened, and clicked per nudge or journey - Automate & Scale

→ Set recurring configs to repeat or update batches

→ Receive automated reports shared with the bank

Share this: