Deposit-linked Rewards for CASA customers

By Editorial Team

5th November 2025

Quick Overview

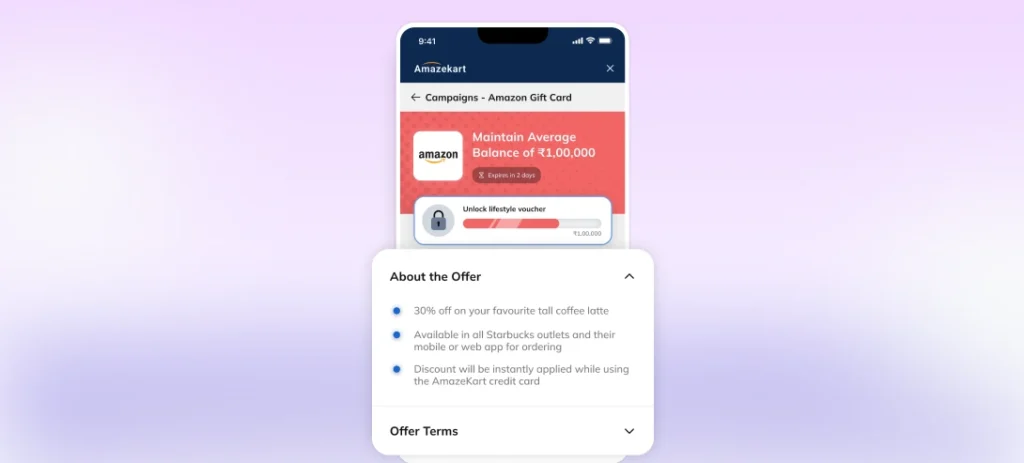

Banks can now link rewards and offers to Savings Account balances, not just credit card activity. This adds a new engagement surface across liabilities, enabling banks to drive deposits, inflows, and relationship growth from CASA customers.

What does it solve

Historically, engagement and rewards have revolved mostly around credit cards and associated spends. Savings accounts — which hold the majority of a customer’s funds — lacked native engagement support.

With CASA-linked rewards on Hyperface Smart Benefits Engine, banks can now:

- Incentivise higher average balances

- Improve primary-bank relationships and inflows

- Create unified reward programs across credit and liabilities

Key Features

- Average Balance Benefits: Configure benefits based on average balances over any chosen duration (e.g. 15 / 30 / 90 days).

- Daily Live Tracking: EOD balances are ingested and the running average recalculated daily — giving customers transparent, real-time progress updates.

- Customer-Level Aggregation: Option to aggregate balances across all of a customer’s accounts, enabling holistic relationship-based rewards.

How does it work?

- The bank configures average balance threshold duration and reward type (cashback, voucher, points, etc.) in the benefit.

- Smart Benefits Engine ingests daily EOD balances for all participating accounts.

- The system calculates the running average daily at account or customer level.

- At the end of the defined period, balances are compared against thresholds.

- Rewards are automatically issued if the qualifying conditions are met.

What you’ll love

- Turns CASA into a dynamic engagement lever

- Drives deposits and inflows through behaviour-linked incentives

- Requires zero custom development, fully configurable from the Hyperface dashboard

Share this: